COMPREHENSIVE GUIDE

From Conceptual to Actionable: How PE Firms Can Create Business Value with AI

In the dynamic realm of private equity (PE), Artificial Intelligence (AI) emerges as a transformative catalyst, reshaping investment strategies and operational paradigms. Across PE firms and their portfolio companies, AI heralds a new era of efficiency, insight, and competitive edge.

Its ability to analyze vast datasets, predict market trends, and optimize decision-making processes propels PE professionals towards more informed and strategic outcomes. However, amidst AI's promises lie challenges of data privacy, talent acquisition, and ethical implementation. As PE ventures navigate this landscape, a strategic balance between innovation and responsibility becomes paramount.

In this comprehensive guide, we delve into the exploration of how PE firms can leverage AI to create substantial business value. We'll cover:

|

4 key dimensions of AI readiness in private equity |

|

|

9 crucial steps to prepare your PE firm’s data for AI |

|

|

AI use cases that add value to PE firms and their portfolio companies |

The integration of Artificial Intelligence (AI) into private equity operations demands a comprehensive evaluation of readiness across multiple dimensions. Assessing AI readiness involves evaluating organizational capabilities, scrutinizing infrastructure and technology, addressing skillset and talent requirements, and ensuring the availability and quality of data. This strategic approach ensures that private equity firms and their portfolio companies are well-prepared for the transformative journey of AI implementation.

Organizational Capabilities

The journey toward AI readiness commences with a thorough evaluation of the private equity firm's and its portfolio companies' capabilities. This encompasses assessing the current state of agility, adaptability, and innovation within both entities. Understanding the organizational culture and its openness to technological transformations is crucial. This assessment forms the foundation for aligning AI strategies with the existing organizational framework at both the private equity level and across its portfolio companies.

Infrastructure and Technology

The infrastructure and technology landscape of a private equity firm and its portfolio companies are pivotal in determining their readiness for AI integration. A comprehensive assessment involves scrutinizing existing IT systems, legacy architectures, and scalability at both levels. This step ensures that the technological foundation is robust enough to support the seamless integration of AI applications across the private equity firm and its diverse portfolio. Identifying and addressing any technological gaps is essential for successful AI implementation across the entire ecosystem.

Skillset and Talent Requirements

AI readiness demands a skilled workforce capable of navigating the complexities of AI technologies at both the PE firm and its portfolio companies. Private equity firms need to evaluate their internal talent pool and that of their portfolio companies, identifying gaps in AI-related skills. Strategies for upskilling existing employees or recruiting talent with the requisite expertise must be implemented at both levels.

Moreover, private equity firms may consider facilitating knowledge-sharing and collaboration among portfolio companies to leverage AI expertise effectively. Partnering with specialized AI and data consultancies can also help augment AI initiatives across the private equity firm and its portfolio, providing access to specialized skills, best practices, and proven methodologies.

Data Quality and Availability

In a recent Deloitte survey, 51% of CEOs indicated that the main barrier to creating business value with AI is data challenges.

Data forms the backbone of AI, and its availability and quality are critical for successful implementation across the private equity firm and its portfolio companies. Assessing AI readiness involves evaluating the existing data landscape within both entities. This includes identifying relevant datasets, assessing their quality, and ensuring they align with the defined AI use cases and objectives.

.png?width=2000&height=2000&name=PE%20success%20story%20(1).png)

PE Success Story: Unifying data for enhanced portfolio insights and reduced risk

Our client, a private equity firm managing a diverse portfolio of investments, faced challenges in leveraging data for strategic decision-making. The firm needed a modern data infrastructure to consolidate disparate datasets, enhance analytical capabilities, and gain deeper insights into overall portfolio performance.

OneSix addressed these needs by creating a data repository to integrate and store data from various portfolio companies, providing a unified view for analysis and reporting. The architecture was designed for scalability to accommodate the firm's expanding portfolio while utilizing Snowflake's data sharing features to foster collaboration and knowledge exchange securely. As a result, the firm gained a holistic view of portfolio performance, improved decision-making, operational efficiency, and deeper investment insights.

Once you complete your organizational assessment, it’s time to focus on preparing your data for AI readiness. There are nine key steps; each one is crucial for building a robust foundation that enables the seamless integration of AI within the private equity landscape.

1.

Define the AI Use Case and Objectives

The initial step in preparing data for AI integration involves clearly defining the AI use case and objectives for the PE firm and its portfolio companies. Private equity firms must pinpoint specific areas where AI can create value, whether it's optimizing operational efficiencies, refining decision-making processes, or enhancing overall business performance. Defining clear objectives ensures that data preparation efforts align with tangible business goals for portfolio companies.

2.

Assess Data Availability and Quality

A pivotal aspect of AI readiness for private equity firms is ensuring the availability and quality of pertinent data. A comprehensive assessment is required to identify relevant datasets that align with the defined use case. Simultaneously, evaluating data quality ensures that the information used for AI applications is accurate, reliable, and devoid of inconsistencies.

3.

Collect and Integrate Data into a Repository

Once data availability and quality are assessed, the next step is collecting and integrating the data into a centralized repository that’s accessible from a Machine Learning (ML) platform. This repository serves as the foundation for AI applications, providing a unified and accessible source of information. Integration ensures that data from various sources is consolidated for comprehensive analysis.

.png?width=377&height=300&name=Data%20Integration%20(1).png)

4.

Clean and Preprocess the Data

Data cleanliness is imperative for effective AI applications in the private equity realm. Cleaning and preprocessing encompass the removal of inconsistencies, handling missing values, and transforming data into a format suitable for analysis. This step ensures that the data used for AI applications within portfolio management is accurate and conducive to extracting meaningful insights.

5.

Employ Feature Engineering Techniques

Feature engineering involves selecting and transforming relevant features within the data to improve model performance. This step enhances the predictive capabilities of AI models, allowing them to extract more meaningful patterns and insights from the data. A feature store further optimizes this process by storing engineered features centrally. This ensures that feature engineering is performed once and stored for reuse across different AI model projects.

6.

Label and Annotate the Data

For some data sources and use cases, labeling and annotating the data is an essential step. This involves assigning relevant labels to data points, enabling the AI model to learn and generalize patterns effectively. Proper labeling ensures that the model is trained on accurately categorized data.

7.

Ensure Data Privacy and Security

Data privacy and security hold paramount importance in AI readiness for private equity firms. Implementation of measures to safeguard sensitive information pertaining to portfolio companies is crucial for compliance with regulatory requirements. Ensuring data privacy builds trust and confidence in the integration of AI applications within the private equity sector.

8.

Validate and Test the Models

Before deploying AI models, thorough validation and testing are indispensable. This involves assessing the model's performance against a validation dataset and conducting rigorous testing to identify potential issues. Validation ensures that the AI model meets predefined criteria and performs reliably in the context of private equity portfolio analysis.

9.

Continuously Monitor and Iterate

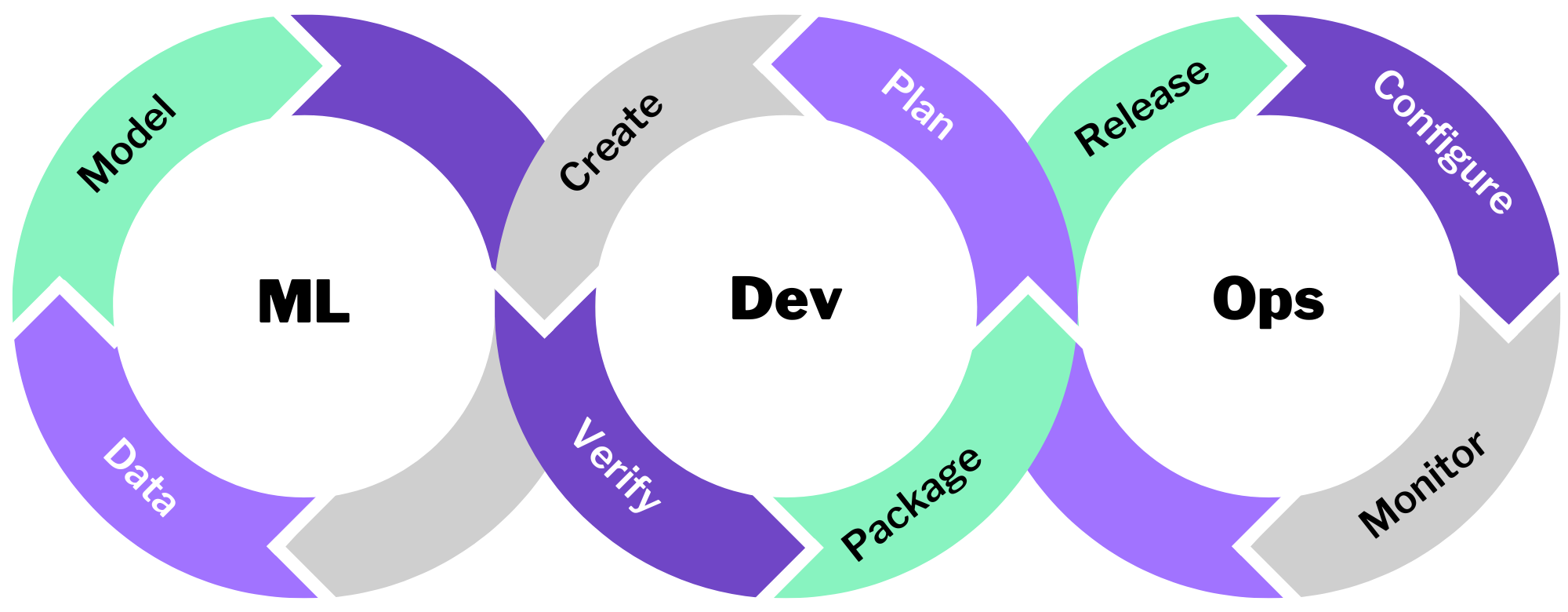

AI readiness is an ongoing process that requires continuous monitoring and iteration, which is a key component of MLOps (Machine Learning Model Operationalization). PE firms should establish mechanisms for monitoring model performance in real-time, identifying any deviations or issues. Continuous iteration involves refining models based on feedback and evolving business requirements.

Private equity firms and their portfolio companies are increasingly leveraging artificial intelligence (AI) to gain competitive advantages, streamline processes, and make data-driven decisions. However, findings from a recent Deloitte survey highlight that 55% of CEOs state the identification of suitable use cases as the primary obstacle to realizing AI's business value.

At OneSix, we believe that use cases must be both immediate and practical. While the potential list is long, we like to start with use cases that advance the organization and provide value within a 6-month time period—and lay a foundation that can be built upon.

Investment Strategy and Risk Management

Trends & Investment Monitoring

Private equity firms can develop custom AI models to predict market trends and assess investment risks effectively. By analyzing vast amounts of financial data and market indicators, AI algorithms can provide valuable insights into potential investment opportunities and risks. Additionally, full-stack AI applications can offer real-time portfolio management capabilities, enabling proactive decision-making and portfolio adjustments.

Unstructured Document Analysis

AI technologies can streamline due diligence processes by extracting key insights from unstructured data sources such as legal documents, market reports, and industry analyses. Advanced natural language processing (NLP) algorithms can sift through large volumes of text, identifying critical information relevant to investment evaluations without requiring extensive machine learning expertise. This streamlining enhances the efficiency and accuracy of due diligence procedures.

Exit Planning

Through comprehensive analysis of market trends, potential buyers, and valuation models, AI-driven insights guide decision-making processes towards maximizing the value of portfolio exits. By utilizing AI algorithms to identify emerging market opportunities, predict buyer behaviors, and assess competitive landscapes, private equity firms can formulate tailored exit strategies that align with overarching investment objectives.

Target Outreach and Analysis

Prospective Target Outreach

Private equity firms can employ AI to streamline outreach efforts to prospective target companies. By generating personalized email drafts using data scraped from public websites and databases, AI algorithms can assist in crafting tailored introductory communications. This automation not only saves time but also ensures that outreach messages are more targeted and impactful.

Prospective Target Analysis

AI-powered language models (LLMs) can gather and summarize public information about prospective target companies from various sources, including press releases, customer reviews, and news articles. By analyzing and synthesizing vast amounts of textual data, LLMs enable private equity firms to gain comprehensive insights into potential investment opportunities quickly and efficiently.

Portfolio Management and Innovation

Portfolio Company Innovations

Within portfolio companies, AI can drive innovation and value creation across various domains. Private equity firms can leverage traditional machine learning techniques for tasks such as demand forecasting, customer segmentation, and operational optimization. Additionally, integrating LLMs into portfolio companies can enable the development of custom chatbots, personalized customer experiences, and advanced analytics solutions, enhancing operational efficiency and competitive positioning.

Investor Profile Summarization

AI technologies, particularly LLMs, can assist private equity firms in summarizing key information about investor relationships. By analyzing communication logs, investment histories, and other relevant data sources, LLMs can generate concise summaries of investor profiles, recent interactions, and investment preferences. This automation reduces manual data entry efforts, enabling private equity professionals to focus more on building and nurturing investor relationships effectively.

Get Started:

AI & ML Use Case Workshop

OneSix's AI & ML Use Case Workshop is tailored to equip both non-technical and technical resources within private equity firms and their portfolio companies with a comprehensive understanding of artificial intelligence (AI) and machine learning (ML), from conception to execution. This workshop is designed to empower participants to explore the potential applications of AI/ML within their firm's specific context, utilizing existing data assets, technology infrastructure, and internal talent.

Workshop Highlights

- Full Lifecycle Understanding: From the initial stages of data collection to the deployment of models, the workshop demystifies the complex process.

- Use-Case Viability Assessment: The workshop provides a framework for participants to assess the viability of their private equity firm's specific use-cases.

- Strategic Pathway for Value Creation: Participants will learn how to navigate the AI landscape in a safe, effective, and cost-aware manner.

- Practical Business Context: The workshop goes beyond theoretical concepts, emphasizing real-world applications and relevance to the participants' professional environments.

- Use-Case Selection in Confined Time Frame: Participants will engage in problem-solving activities to identify and select top model candidates for their use-cases.

Workshop Leader

Who Should Attend

- Business leaders seeking strategic insights for AI/ML implementation

- Data teams looking to explore and evaluate potential AI/ML use-cases

Key Takeaways

By the end of the workshop, participants will not only have a clear understanding of the ML lifecycle but also a strategic roadmap for leveraging AI/ML in their PE firm and portfolio companies. The emphasis is on practicality, ensuring that participants can apply their knowledge immediately to drive impactful and measurable outcomes.

.png?width=1000&height=1000&name=Ross-AI%20(1).png)