COMPREHENSIVE GUIDE

From Conceptual to Actionable: How Banks Can Create Business Value with AI

.png?width=2000&height=2000&name=Banking%20AI%20(3).png)

The banking industry stands at the forefront of a transformative wave, poised to unlock substantial business value through the integration of generative Artificial Intelligence (AI). McKinsey estimates that the adoption of generative AI could yield a remarkable impact, generating value equivalent to 2.8 to 4.7 percent of the industry's annual revenues—a staggering additional $200 billion to $340 billion.

This potential extends beyond mere productivity gains, encompassing enhancements in customer satisfaction, improved decision-making processes, and an enriched employee experience. In addition, the integration of generative AI holds the promise of mitigating risks through more robust fraud monitoring and risk management strategies.

In this comprehensive guide, we delve into the exploration of how banks can leverage AI to create substantial business value. We'll cover:

|

4 key dimensions of AI readiness in banking |

|

|

9 crucial steps to prepare your banking data for AI |

|

|

AI use cases that add value to banking institutions |

The integration of Artificial Intelligence (AI) into the banking sector requires a comprehensive evaluation of readiness across multiple dimensions. Assessing AI readiness involves evaluating organizational capabilities, scrutinizing infrastructure and technology, addressing skillset and talent requirements, and ensuring the availability and quality of data. This strategic approach ensures that banks are well-prepared for the transformative journey of AI implementation.

Organizational Capabilities

The journey toward AI readiness begins with a thorough evaluation of the organization's capabilities. This encompasses assessing the current state of agility, adaptability, and innovation within the banking institution. Understanding the organizational culture and its receptiveness to technological transformations is crucial. This assessment serves as the foundation for aligning AI strategies with the existing organizational fabric.

Infrastructure and Technology

The infrastructure and technology landscape of a bank play a pivotal role in determining its readiness for AI integration. A comprehensive assessment involves scrutinizing existing IT systems, legacy architectures, and scalability. This step ensures that the technological foundation is robust enough to support the seamless integration of AI applications. Any gaps in technology must be identified and addressed to pave the way for successful AI implementation.

Skillset and Talent Requirements

AI readiness necessitates a skilled workforce capable of navigating the complexities of AI technologies. Banks need to evaluate their current talent pool, identifying gaps in AI-related skills. Strategies for upskilling existing employees or hiring talent with the requisite expertise must be implemented.

In addition to developing in-house talent, banks may explore the option of partnering with a specialized AI and data consultancy to augment their AI initiatives. Collaborating with a consultancy can accelerate the AI journey by providing access to specialized skills, best practices, and proven methodologies.

Data Quality and Availability

In a recent Deloitte survey, 51% of CEOs indicated that the main barrier to creating business value with AI is data challenges.

Data is the lifeblood of AI, and its availability and quality are paramount for successful implementation. Assessing AI readiness involves evaluating the existing data landscape within the bank. This includes identifying relevant datasets, assessing their quality, and ensuring they align with the defined AI use cases and objectives.

Leader Bank: From Siloed Data to a Unified 360° View of the Customer

To maintain a competitive edge, community banks need to have a deep understanding of customer behavior and preferences. For Leader Bank, the path to success was marred by fragmented systems and disjointed data, hindering their ability to provide efficient customer service and targeted marketing efforts. This is where OneSix stepped in, bringing an innovative Community Bank 360° solution to address these challenges and transform Leader Bank’s operations.

1.

Define the AI Use Case and Objectives

The first step in preparing data for AI readiness involves clearly defining the AI use case and objectives. Banks must identify specific areas where AI can deliver value, whether it's in enhancing customer experiences, optimizing internal processes, or improving decision-making. Defining clear objectives ensures that data preparation efforts are aligned with tangible business goals.

2.

Assess Data Availability and Quality

A critical aspect of AI readiness is ensuring that the necessary data is available and of high quality. Banks need to conduct a thorough assessment of data availability, identifying relevant datasets for the defined use case. Simultaneously, assessing data quality ensures that the information used for AI applications is accurate, reliable, and free from inconsistencies.

3.

Collect and Integrate Data into a Repository

Once data availability and quality are assessed, the next step is collecting and integrating the data into a centralized repository that’s accessible from a Machine Learning (ML) platform. This repository serves as the foundation for AI applications, providing a unified and accessible source of information. Integration ensures that data from various sources is consolidated for comprehensive analysis.

.png?width=377&height=300&name=Data%20Integration%20(1).png)

4.

Clean and Preprocess the Data

Data cleanliness is imperative for effective AI applications. Cleaning and preprocessing involve removing inconsistencies, handling missing values, and transforming data into a format suitable for analysis. This step ensures that the data used for AI is accurate and conducive to generating meaningful insights.

5.

Employ Feature Engineering Techniques

Feature engineering involves selecting and transforming relevant features within the data to improve model performance. This step enhances the predictive capabilities of AI models, allowing them to extract more meaningful patterns and insights from the data. A feature store further optimizes this process by storing engineered features centrally. This ensures that feature engineering is performed once and stored for reuse across different AI model projects.

6.

Label and Annotate the Data

For some data sources and use cases, labeling and annotating the data is an essential step. This involves assigning relevant labels to data points, enabling the AI model to learn and generalize patterns effectively. Proper labeling ensures that the model is trained on accurately categorized data.

7.

Ensure Data Privacy and Security

Data privacy and security are paramount considerations in AI readiness. Banks must implement measures to protect sensitive customer information and comply with regulatory requirements. Ensuring data privacy builds trust and confidence in AI applications.

8.

Validate and Test the Models

Before deploying AI models, thorough validation and testing are essential. This involves assessing the model's performance against a validation dataset and conducting rigorous testing to identify potential issues. Validation ensures that the AI model meets predefined criteria and performs reliably.

9.

Continuously Monitor and Iterate

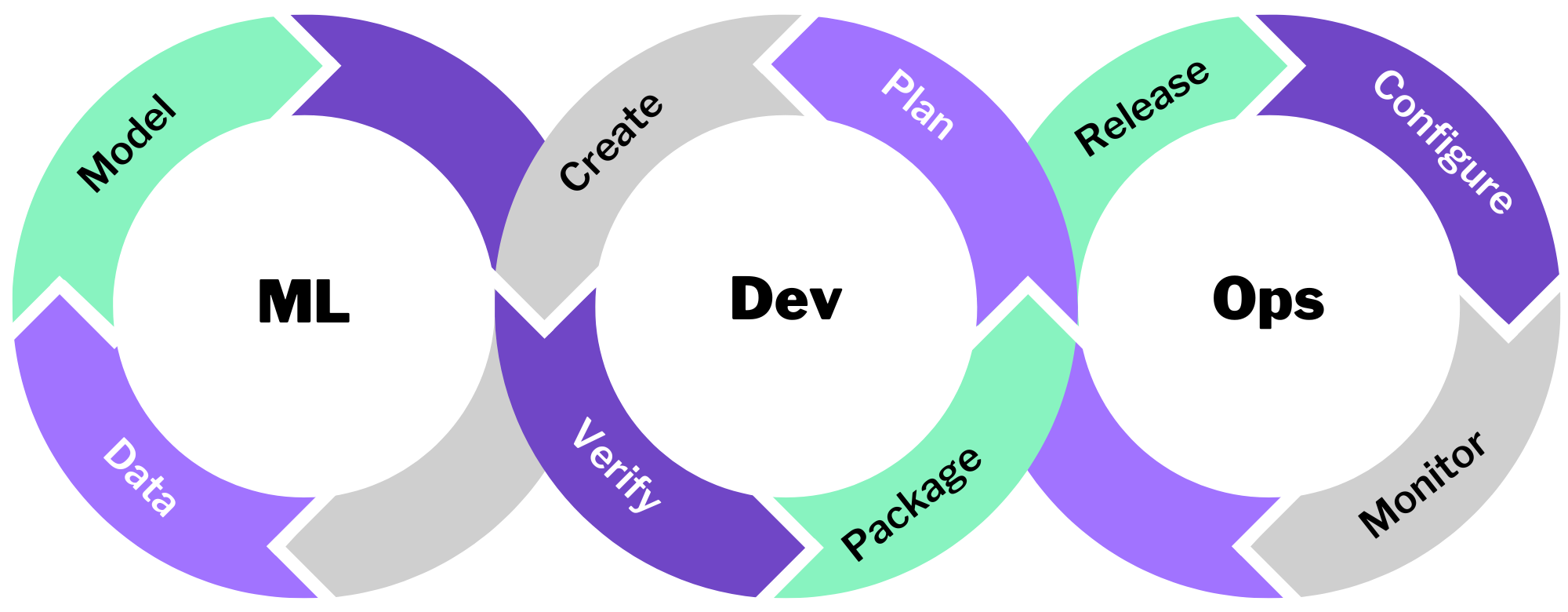

AI readiness is an ongoing process that requires continuous monitoring and iteration, which is a key component of MLOps (Machine Learning Model Operationalization). Banks should establish mechanisms for monitoring model performance in real-time, identifying any deviations or issues. Continuous iteration involves refining models based on feedback and evolving business requirements.

Artificial Intelligence (AI) has emerged as a transformative force in the banking sector, revolutionizing various departments and processes. From enhancing customer experiences to streamlining operations, banks are leveraging AI across multiple dimensions. However, findings from a recent Deloitte survey highlight that 55% of CEOs state the identification of suitable use cases as the primary obstacle to realizing AI's business value.

At OneSix, we believe that use cases must be both immediate and practical. While the potential list is long, we like to start with use cases that advance the organization and provide value within a 6-month time period—and lay a foundation that can be built upon.

Operational Efficiency Gains

Automation of Routine Tasks

AI plays a crucial role in automating mundane and repetitive tasks within banking operations. This includes tasks like data entry, document verification, and transaction processing. Automation not only reduces human error but also significantly accelerates the speed at which these tasks are performed.

Streamlining Internal Processes

Through advanced algorithms, AI optimizes internal processes, making them more efficient and seamless. This streamlining extends to back-office operations, compliance checks, and workflow management. The result is a more agile and responsive banking infrastructure.

Cost Reduction and Resource Optimization

The implementation of AI leads to cost reduction by automating processes and minimizing resource requirements. By automating routine tasks, banks can allocate resources more strategically, focusing on high-value activities that require human expertise.

Enhancing Customer Experience

Personalized Services and Recommendations

AI analyzes customer behavior and interactions to provide personalized financial products and services. This level of customization enhances customer satisfaction, fosters loyalty, and strengthens the overall relationship between banks and their customers.

Chatbots and Virtual Assistants

Implementing AI-driven chatbots and virtual assistants improves customer engagement by providing instant and accurate responses to inquiries. These intelligent systems not only save time but also contribute to cost savings for banks while delivering a seamless customer experience.

Improved Customer Engagement

AI helps banks understand customer preferences, enabling the production of tailored content at scale. This personalized approach to communication enhances customer engagement, increases brand loyalty, and positions banks as customer-centric entities.

Better Decision Making

Predictive Analytics for Strategic Decision Making

AI leverages predictive analytics to analyze vast datasets and forecast future trends. This capability aids banking executives in making strategic decisions, from identifying investment opportunities to predicting market shifts. By providing actionable insights, AI empowers decision-makers to navigate the dynamic landscape with confidence.

Real-time Insights for Agile Responses

In a rapidly changing financial landscape, the ability to make real-time decisions is paramount. AI equips banks with the capability to gather and analyze data in real-time, enabling agile responses to market fluctuations, regulatory changes, and emerging risks. This agility is a key differentiator in a competitive banking environment.

Optimizing Resource Allocation

Through advanced algorithms, AI assists banks in optimizing resource allocation. Decision-makers can strategically allocate resources based on data-driven insights, ensuring that human capital and financial resources are directed towards initiatives with the highest potential for returns. This optimization contributes to overall operational efficiency.

Risk Management and Compliance

AI's analytical prowess extends to risk management and compliance functions. By continuously monitoring data for anomalies and potential risks, AI provides decision-makers with early warnings and insights to proactively manage risks. This is particularly crucial in the highly regulated banking industry, where compliance is a top priority.

Fraud Detection and Security

AI-powered Fraud Prevention Systems

Utilizing machine learning and cognitive capabilities, AI identifies patterns associated with fraud, preventing financial losses for banks. These systems can detect anomalies, identify potential threats, and take preemptive measures to secure financial transactions.

Enhancing Cybersecurity Measures

AI enhances cybersecurity in banking by continuously monitoring and analyzing vast amounts of data for potential security breaches. The proactive identification of threats helps banks fortify their cybersecurity measures, safeguarding customer data and maintaining trust.

Protecting Customer Data and Privacy

Through AI, banks implement robust data protection measures, ensuring compliance with privacy regulations. AI-driven solutions are adept at identifying and mitigating risks associated with data breaches, thereby safeguarding customer information.

Get Started:

AI & ML Use Case Workshop

OneSix's workshop is designed to provide both non-technical and technical teams with a practical understanding of AI and machine learning (ML) from inception to implementation. The workshop aims to empower participants to explore the potential of AI/ML within their bank's specific context, leveraging data, tech, and internal resources.

Workshop Highlights

- Full Lifecycle Understanding: From the initial stages of data collection to the deployment of models, the workshop demystifies the complex process.

- Use-Case Viability Assessment: The workshop provides a framework for participants to assess the viability of their bank's specific use-cases.

- Strategic Pathway for Value Creation: Participants will learn how to navigate the AI landscape in a safe, effective, and cost-aware manner.

- Practical Business Context: The workshop goes beyond theoretical concepts, emphasizing real-world applications and relevance to the participants' professional environments.

- Use-Case Selection in Confined Time Frame: Participants will engage in problem-solving activities to identify and select top model candidates for their use-cases.

Workshop Leader

Who Should Attend

- Business leaders seeking strategic insights for AI/ML implementation

- Data teams looking to explore and evaluate potential AI/ML use-cases

Key Takeaways

By the end of the workshop, participants will not only have a clear understanding of the ML lifecycle but also a strategic roadmap for leveraging AI/ML in their financial institutions. The emphasis is on practicality, ensuring that participants can apply their knowledge immediately to drive impactful and measurable outcomes.

.png?width=1000&height=1000&name=Ross-AI%20(1).png)